Information Technology and Ethics/Cryptocurrency Legal & Ethical Perspectives

Legal Issues

[edit | edit source][1]Ever since Bitcoin became successful, the legalization of cryptocurrency has been a hot issue. There are several cryptocurrencies other than Bitcoin (BTC), such as Ethereum (ETH), Litecoin (TCC), Dash, Ripple, etc., which is why it is hard to keep track of which country is allowing which cryptocurrency. A concerning problem regarding cryptocurrency is the many legal issues that surround it. Some governments tend to shy away from this currency while others have chosen to embrace it. Considering these issues vary in complexity, it would be appropriate to highlight the different legal matters surrounding crypto:

- [2]Regulation: Since Crypto is a relatively recent concept, governments around the globe are still adapting to it with their regulations. These regulations vary from country to country, with some countries having fairly lax regulations, while others either are not allowing the usage of Cryptocurrency or are very strict with their policies. Since there is such variety, businesses often have to pick and choose where their operations are being conducted if they are utilizing Cryptocurrency as part of the business.

- KYC Compliance: KYC (Know your Customer) makes sure crypto exchanges verify identities of their customers in order to highlight suspicious individuals.

- [3]Security: As we know, there are many concerns surrounding the security of different cryptocurrencies. Many crypto accounts are subject to getting hacked and it has been a large issue for the government to address without enforcing harsher regulations. These issues will only continue to grow in size as we move forward.

- Money Laundering: With Cryptocurrency being another method of investing, many individuals have been able to use it as a way of laundering illegal money. Since traders have the right to remain completely anonymous, they have utilized black market sites to buy & sell items that would be illegal in public transactions.

Legal Standpoints

[edit | edit source]Although not every country is allowing cryptocurrency, there are a lot of countries that are allowing some cryptocurrencies. For example, Bitcoin is legal in the United States, Canada, Japan, Germany, etc.[4] Some countries that do not allow any type of cryptocurrencies are Algeria, Bolivia, Vietnam, and Saudi Arabia.[4] There are some “undecided” countries as well such as Argentina, Columbia, Peru, Nigeria, and the United Arab Emirates.[5] These countries do not ban Bitcoin or cryptocurrencies, but they do not have any clear laws or regulations.[5]

[6]Due to the fact that crypto is a fairly new concept and the unpredictability of it, countries across the globe have differing opinions on it. Countries have either fully embraced the concept, outright denied it, or are still uncertain on how to approach the regulation of it.

[7]For example, the United Kingdom has taken a rather progressive approach to the handling of crypto as their regulations have already been set and they have even looked into central bank digital currencies. Japan has also been an early participant in the adoption of cryptocurrency as they allowed bitcoin to be used as payment starting in 2017. The framework that they have created is rather advanced and requires exchanges to obtain licenses to operate.

On the other hand, there are countries that have taken a more strict approach to the introduction and adoption of cryptocurrencies. China has already banned cryptocurrency exchanges within the country since 2017. India has also taken a cautious approach to crypto as they have already banned all private cryptocurrencies.

Usage

[edit | edit source]

Cryptocurrency, a digital currency, was first created in 2009. It was developed because the internet had to rely on financial institutions serving as third parties for electronic payments. Bitcoin was created to be free of those extra payments, and its goal was to establish an electronic payment system based on cryptographic proof rather than trust, enabling any two willing parties to conduct business directly with one another without the assistance of a reliable third party.[8] Cryptocurrency serves the purpose of enabling digital transactions using digital identities.

People utilize cryptocurrencies for a variety of purposes,

- including making fast payments,

- avoiding transaction fees from traditional banks,

- taking advantage of the anonymity they provide.

Some people invest in cryptocurrencies in the hopes that their value will increase.[9] The low cost provided by crypto has prompted other countries such as China, Japan, and Sweden to conduct trials of their own digital currencies. The low cost has also led banks to create digital versions of their own currency.

Examples of Usage in Other Countries of Cryptocurrency

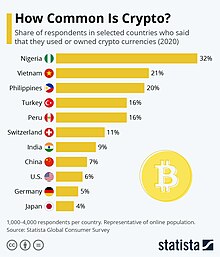

[edit | edit source]A survey conducted by Pew Research in 2023 showed that 69% of people in the US who have invested in cryptocurrency still hold crypto, while 31% who used it do not have it anymore. People who bought crypto, the majority of them in the US, still have it invested across all age groups.[10]In Nigeria, 32% have used or owned cryptocurrency (2020).[11] In Nigeria, it is legal to own and do business with cryptocurrency, and many businesses opt for it to protect themselves from inflation and third-party payments. Another country where cryptocurrency is used (20%) is Vietnam because it is fast and accessible in the region.[11] In the Philippines, even the government encouraged it by setting up a blockchain app, bonds.ph, with Union bank for government bonds allocation.[11] The Union bank installed a Bitcoin ATM in Makati (Metro Manila) which shows that Bitcoin is used widely.[11] Finally Illegal activity online, such as the "dark web," uses cryptocurrency because it offers anonymity. The Government Accountability Office stated that out of the 27 online commercial sex marketplaces looked at, 15 accepted virtual currency in a June 2021 research. The purchase, sale, and exchange of virtual currencies can be facilitated via virtual currency in a June 2021 research. Furthermore, the purchase, sale, and exchange of virtual currencies can be facilitated via virtual currency ATMs, which are standalone devices for drug trafficking.[12] These are some of the unethical uses of Crypto Currency. which then the question of regulation comes in.

Regulation Problems

[edit | edit source]Cryptocurrencies have a big problem; they are not regulated. This is also one of the reasons why countries are hesitant to allow them. Countries have to make their own laws and regulations when making Bitcoin and other cryptocurrencies legal. For example, in the United States, cryptocurrency transactions fall under the scope of the Bank Secrecy Act (BSA).[13] This implies that cryptocurrency exchange service providers must have the appropriate license approved by Financial Crimes Enforcement Network (FinCEN), implement an Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT) and Sanctions program, maintain appropriate records, and submit reports to authorities.[13] The US Securities and Exchange Commission (SEC) views cryptocurrencies as securities which is why they apply securities laws to digital wallets.[13] Furthermore, FinCEN expects crypto exchanges to comply with record-keeping requirements and the “Travel Rule” in response to Financial Action Task Force (FATF)’s guidelines published in June 2019.[13]

There are some countries that have developed their own cryptocurrency. For example, Venezuela launched Petro in February 2018. According to their December 2017 announcement, it was supposed to be backed up by the country's oil and mineral reserves and was intended to supplement Venezuela’s bolívar fuerte currency.[14] As of August 2018, Petro appears to not be a currency, although Venezuela’s government said that their new currency, soberano, has connections with it.[14]

Russia has also developed its own crypto, CryptoRubble, in October 2017.[15] This cryptocurrency was issued by Russia’s Central Bank.[15] The unique aspect of this cryptocurrency is that it is managed by the Russian government.[15] One of the reasons they are doing this is to circumvent financial sanctions that have been placed on them.[15]

Ethical Issues

[edit | edit source]The ethical consequences of blockchain technology can be diverse and wide-ranging, and have a huge impact on one’s social life. Blockchain can be an invaluable tool of democracy on the other hand it can also be used by governments or other private entities to exert and consolidate power over people and information. Cryptocurrency as crypto-economic plays a critical role in increasing financial inclusion and creating innovative microeconomies, and these structures can also create exploitative systems or undermine existing payment and financial systems. In recent years the effective anonymity of cryptocurrencies has also been used for criminal activity at large. Whereas blockchain has the ability to restore personal control over data, it could also have the effect of consolidating and codifying the control of certain entities over information and personal data due to the immutability nature of this technology.[16]

[17]The following examples represent some of the many potential consequences of the trade-offs made in blockchain design. These examples are meant to be representative, not comprehensive; they illustrate the breadth of the challenges and potential consequences that arise from the practical applications of blockchain design and implementation. At one end of the impact spectrum, blockchain technologies could create or exacerbate severe power inequities in communities, or they could consolidate power over individuals and information by entities that design and implement the technology to their own advantage. At the other end of the impact spectrum, particular technical design issues such as private key systems and encryption algorithms are presented to show that even these seemingly innocuous design details can significantly affect people.[16]

Some of the ethical issues with Blockchain are:

[18]Digital Identity

[edit | edit source]A vital component of our growing digital environment is digital identification, where confirming one's identity online is necessary to use services, complete transactions, and maintain security. Blockchain technology delivers a novel method of controlling digital identities, giving users more security, privacy, and control. But it also brings up issues and moral dilemmas that must be resolved. The issues are:

- Diversity and Access: Blockchain technology can improve personal data management, but it needs internet and technological access.

- Data Privacy: Although blockchain offers privacy characteristics, improper security could lead to the exposure of sensitive personal data.

- Legal Compliance: Identity systems built on blockchain need to abide by rules like KYC standards and data protection legislation.[17]

Anonymity

[edit | edit source][19]A key component of blockchain technology is anonymity, especially when it comes to cryptocurrency. It describes people's capacity to participate in events or transactions without disclosing who they are. Although this feature grants privacy and autonomy, it also poses moral conundrums and difficulties that require thoughtful analysis. It contains:

- Illegal operations: The anonymity provided by blockchain technology can be used for illicit operations like financing terrorism, money laundering, and drug trafficking.

- Transparency vs. Privacy: Although anonymity features of blockchain technology encourage transparency, there may be conflicts between the need for privacy and the requirement for transparency in some situations

- Accountability: Being anonymous can make it more difficult to hold someone accountable for their deeds.[18]

Dependency on Passwords

[edit | edit source][20]Private keys, which are effectively complicated passwords, are frequently necessary for the security and management of digital assets in blockchain technology. To access and manage assets based on blockchain technology, such as cryptocurrency, these keys are essential. Yet there are several moral and practical issues with this reliance on passwords. This includes:

- Asset Loss: A user will always be unable to access their assets if they misplace their private key.

- Security Risks: Unauthorized individuals may be able to access and take advantage of the user's assets if they are breached, taken, or compromised.

- User Responsibility: Since blockchain technology is decentralized, users cannot turn to a central authority to retrieve misplaced keys or compromised funds.[19]

Blockchain as a tool for democracy

[edit | edit source][21]Blockchain technology could be a very useful instrument for strengthening democracy. Its decentralization, security, and transparency qualities can be used to enhance a variety of democratic processes. However, there are problems and ethical issues with adopting blockchain in this situation that must be resolved. The issues are:

- Digital Divide: Widespread usage of technologies and the internet is necessary for blockchain to be a useful instrument for democracy.

- Privacy Issues: Blockchain's transparency is an important component, but it must be weighed against privacy issues.

- Potential for Abuse: Blockchain technology may be abused by governments or other strong organizations to monopolize power, monitor the public, or falsify data.[20]

Immutability

[edit | edit source]Immutability is a key feature of blockchain technology. The security and integrity of the data saved on the blockchain depend on this feature. It also brings up several moral questions and difficulties. It has:

- Right to be Forgotten: This allows people to ask for the removal of their personal data, in contradiction with privacy rights due to the confidentiality of blockchain technology. Once data is entered into a blockchain, it is difficult to remove or change it.

- Error Correction: In conventional databases, records can be updated or deleted to fix errors. However, since blockchain data cannot be changed, errors are irreversible, which might have dangerous repercussions if sensitive or inaccurate information is stored.[21]

References

[edit | edit source]- ↑ "Cryptocurrency Laws and Regulations". Justia. 2023-04-11. Retrieved 2024-04-23.

- ↑ GLI. (2024, April 19). Blockchain & Cryptocurrency Laws and Regulations | USA. https://www.globallegalinsights.com/practice-areas/blockchain-laws-and-regulations/usa/

- ↑ Freeman Law. (2023, November 11). Legal issues surrounding cryptocurrency | Freeman Law. https://freemanlaw.com/legal-issues-surrounding-cryptocurrency/

- ↑ a b Cryptonews. (2020). Countries Where Bitcoin Is Banned or Legal In 2020. Cryptonews; Cryptonews. https://cryptonews.com/guides/countries-in-which-bitcoin-is-banned-or-legal.htm

- ↑ a b Gupta, A. (2018, May 15). List of Countries where Bitcoin/ICO/Cryptocurrency is legal & Illegal. SAG IPL - a Technology Blog. https://blog.sagipl.com/legality-of-cryptocurrency-by-country/

- ↑ "Blockchain & Cryptocurrency Laws and Regulations | USA". GLI. Retrieved 2024-04-23.

- ↑ Linares, M. G. S. (2023, December 27). Crypto wrestles with legal issues, scoring a few key victories, in 2023. Forbes. https://www.forbes.com/sites/digital-assets/2023/12/27/crypto-wrestles-with-legal-issues-scoring-a-few-key-victories-in-2023/?sh=2ec0fc16545c

- ↑ Nakamoto, S. (2008). Bitcoin: a Peer-to-Peer electronic cash system. https://bitcoin.org/bitcoin.pdf

- ↑ What to know about cryptocurrency and scams. (2024, March 4). Federal Trade Commission Consumer Advice. https://consumer.ftc.gov/articles/what-know-about-cryptocurrency-and-scams

- ↑ Sidoti, Michelle Faverio and Olivia (2023-04-10). "Majority of Americans who've ever invested in crypto still have it, but it varies by household income, gender". Pew Research Center. Retrieved 2024-04-23.

- ↑ a b c d Buchholz, K. (2021, February 18). What countries use cryptocurrency the most? World Economic Forum. https://www.weforum.org/agenda/2021/02/how-common-is-cryptocurrency/

- ↑ Office, U. S. Government Accountability (2024-01-16). "As Virtual Currency Use in Human and Drug Trafficking Increases, So Do the Challenges for Federal Law Enforcement | U.S. GAO". www.gao.gov. Retrieved 2024-04-23.

- ↑ a b c d ComplyAdvantage. (2021, March 25). Crypto Regulations in the United States. ComplyAdvantage. https://complyadvantage.com/knowledgebase/crypto-regulations/cryptocurrency-regulations-united-states/

- ↑ a b Wikipedia Contributors. (2021, April 20). Petro (cryptocurrency). Wikipedia; Wikimedia Foundation. https://en.wikipedia.org/wiki/Petro_(cryptocurrency)

- ↑ a b c d Frankenfield, J. (2021, April 6). CryptoRuble. Investopedia. https://www.investopedia.com/terms/c/cryptoruble.asp#:~:text=The%20CryptoRuble%20is%20a%20digital,value%20of%20a%20regular%20ruble

- ↑ a b Lapointe, C & Fishbane L (2018). The Blockchain Ethical Design Framework. https://beeckcenter.georgetown.edu/wp-content/uploads/2018/06/The-Blockchain-Ethical-Design-Framework.pdf

- ↑ a b Sharif, M., & Ghodoosi, F. (2022b). The ethics of blockchain in organizations. Journal of Business Ethics, 178(4), 1009–1025. https://doi.org/10.1007/s10551-022-05058-5

- ↑ a b Chuen, D. L. K., Guo, L., & Wang, Y. (2017). Cryptocurrency: a new investment opportunity? The Journal of Alternative Investments, 20(3), 16–40. https://doi.org/10.3905/jai.2018.20.3.016

- ↑ a b Haddouti, S. E., & Kettani, M. D. E. E. (2019). Analysis of Identity Management Systems Using Blockchain Technology. An Exploration of Technical Challenges and Solutions. https://doi.org/10.1109/commnet.2019.8742375

- ↑ a b Conti, M., Kumar, E. S., Lal, C., & Ruj, S. (2018). A Survey on Security and Privacy Issues of Bitcoin. IEEE Communications Surveys and Tutorials/IEEE Communications Surveys and Tutorials, 20(4), 3416–3452. https://doi.org/10.1109/comst.2018.2842460

- ↑ a b Angiulli, F., Fassetti, F., Furfaro, A., Piccolo, A., & Saccà, D. (2018). Achieving service accountability through blockchain and digital identity. In Lecture notes in business information processing (pp. 16–23). https://doi.org/10.1007/978-3-319-92901-9_2