Strategy for Information Markets/Monopoly

Monopoly

[edit | edit source]A monopoly is a market structure where there is only one supplier of a product and there is no close substitute of this product. In a monopoly, a business has the market power to set any price it wants for a certain product.

Creating and maintaining a monopoly

[edit | edit source]Different types of monopolies are usually formed under distinct conditions or with some strategies. In addition to these conditions, establishing certain barriers to prevent other firms' entries to the market, is required to maintain a monopoly in the market.

Natural monopoly

[edit | edit source]Natural Monopolies are formed under the special condition in markets, when it would be more cost effective to just have one large firm produce a product than to have two or more firms producing the same good. If indicates the quantity that is produced by a natural monopoly in a market and represent the output of the firms that produce the same product, let

If is the total cost function of the production, then we have

Therefore, it is cheaper for just one firm to produce while the marginal cost is constant or declining, and the average cost drops as the quantity increases. For instance, let's assume that there are two firms in a natural monopoly's market and each of them produces half of the quantity that the monopoly produces. As the graph illustrated on the right, the total cost of the natural monopoly is cheaper than the sum of the total costs of the two firms producing the same quantity.

Within the realm of information goods, software can be considered as an example of natural monopoly. The development of a software might be expensive as a sunk cost at the beginning, but the marginal cost of software is low and constant. Hence, the economies of scale is large for software producers. Additionally, software has the natural barriers of formality, so competitors are usually efficiently blocked from entering the market.

However, sometimes a natural monopoly cannot exist under a perfect competitive market even if it would be more cost effective for just one natural monopoly to produce. Because the factor of price could kill the profits for a natural monopoly. Please go to the section of "Perfect Competitive Markets to Information Goods" at the page of Competition for the market to learn more about the situation of natural monopolies in perfect competitive markets.

Government created monopolies

[edit | edit source]Government Monopolies refers to monopolies that have the state as an directly invested partner (a state is intrinsically invested in every national business, for instance for taxation), even if not specifically the sole owner. Normally there will exist some national legislation that grants the government discretion over core strategies, even if only holding a minority position (see Golden share). These monopolies may benefit not only from governmental information but from the creation of legal barriers to prevent competitors to function in equal footing, mostly nationally but these legislations can be extended into international treaties.

Knowledge advantage

[edit | edit source]For a firm to stay a monopoly there has to be some barriers to enter. The three main ones are: Legal barriers, patents, and natural barriers. Legal barriers are where the government has regulations or sets jurisdiction where only a certain product can be produced or sold. This makes it almost impossible for another firm to enter this market. Another one is patents that gives the rights to the inventor of a product to have monopoly for a certain amount of time to produce and sell the product.

There are three things for a true monopoly to exist: A single seller, no close substitutes, and barriers to entry. The market power brought on by being the only seller lets them set prices instead of having the market set the price of a good do to demand and supply.

An example of a monopoly would be AT&T (Bell Telephone). If you wanted telephone service, you had to have a Bell Telephone and nothing else. For almost a century, AT&T operated as monopoly in the United States. In 1984, the company was forced to split and the government put a cap on the companies profits.

Mergers and acquisitions

[edit | edit source]Mergers and Acquisitions (M&A) is a common strategy that was used to create a monopoly. In U.S. economy history, Robber Barons frequently established monopolies to manipulate the market, especially before 1890, the year that Sherman Antitrust Act was passed. Sherman Antitrust Act was a monumental law to indicate the start of protecting competitive markets.

Price discrimination

[edit | edit source]Price discrimination is when a firm produces a product with the same marginal cost and sells it at a different price. This can efficiently get the most possible surplus from the market, but it primarily benefits the seller the most. Arbitrage is seen in this market were the buyer purchases the good at a lower price and sells it at a higher price.

In order for a firm to be able to price discriminate, the following criteria must be met:

- The firm must have market power.

- The firm must be able to recognize differences in demand. The firm must be able to identify and recognize that there exist different consumer groups that may have different willingness-to-pay for the product or service. If the seller does not know the preferences of the different groups, the firm will often deploy a tactic called versioning, in which the firm offers different products and then allows customers to "self-select" into these different groups. The firm must not always have to know the exact fluctuations in demand, but this is primarily where technique lies.

- The firm must lastly have the ability to prevent arbitrage, or resale of the product. Establishing barriers to arbitrage is critical if the seller wants to price discriminate because if consumers who purchase the product turn around and sell the product for a lower price than the firm, then the firm essentially begins competing with itself and will eventually lose its market. An example of a firm creating such a barrier is Microsoft Office: when a person buys Office, Microsoft prevents the resale of the product by having a special product key with the software that is only valid for a one time use.

Types of price discrimination

[edit | edit source]First Degree Price Discrimination First Degree Price Discrimination, or perfect price discrimination, is when the seller can charge the exact highest price the buyer is willing to pay for each good or service sold. Under this type of price discrimination, the seller is able to adequately capture the entire market surplus, transforming all consumer surplus into revenue for the seller. First degree price discrimination is both statically and dynamically efficient in that it maximizes total value, with no deadweight loss to society and the firm capturing all the wealth. This type of price discrimination is generally not very realistic as no one can fully know the willingness to pay of every individual buyer. Under this type of price discrimination the price would be different for every buyer in the market so the Marginal Revenue (MR) curve would lie directly on top of the Demand curve.

Second Degree Price Discrimination Second degree price discrimination is when a seller offers different prices based on the amount of goods a buyer purchases. Costco is a good example of this, they charge lower prices for the goods because you are buying in bulk. The quantity that someone buys will determine the price they will get. Another example that utilization of market power is Wal-Mart. Wal-Mart offers generic products at a lower price, therefore their market power in the United States allows them to purchase much more quantity at a lower price.

Two-Part Tariff A two-part tariff is a form of second degree price discrimination in which a good or service is typically sold in two parts: a lump-sum fee and a per-unit price. The lump-sum fee is a fee that the consumer must pay so that it can enter the market and be granted access to be able to purchase the good or service. An example of a two-part tariff is a phone company offering a network contract and then additional hardware such as phones, tablets, etc. A two-part tariff is strategically used by a seller because it can offer the seller to charge lower prices, since it can recapture the lost revenues in the form of the lump-sum fee. The fee also allows the seller to effectively capture all of the consumer surplus. Two-part tariffs can often be presented as different options (or versions), allowing customers again to self-select. Cell phone companies offer different types of contracts that are made readily available to the consumer.

Third Degree Price Discrimination Third degree price discrimination is often referred to as "group pricing" and market segmentation. This pricing strategy allows a seller to charge different prices to different groups of consumers, which the seller may or may not be able to identify. To do this, many firms will use versioning, or offering different versions of essentially the same product so buyers can sort themselves (profitably) into groups. This could be designing differences which appeal to different tastes (e.g. producing a movie in 3D) or designing differences in quality (e.g. software—home,student, pro versions). This is also often done for students or senior citizens, in the form of student/senior discounted tickets. This is done because both seniors and students generally have less disposable income than a normal working person. Because the seller is permitted to identify the consumer, arbitrage is pre-empted.

A little about price discrimination (Legality)

[edit | edit source]Price discrimination is a legal attempt by a producer or seller to charge a different price to various groups of individuals for the same product based on consumer willingness to pay. Price discrimination can be illegal however if the manufacturer of the product is only price discriminating to make it more appeal in a particular area. For example, there was an issue with beer companies in the 60's pricing below a competitors price in one area to try to run another out of business but right down the street it was not at a lower price. Price discrimination is often a difficult issue whether it is legal or not. There are three degrees of price discrimination, but before one can begin to price discriminate, there are two criteria that must be fulfilled:

- First, the seller must be able to identify the different groups that are trying to purchase the product. If the seller does not know the preferences of various groups, then it will be difficult to determine pricing levels that will maximize profit. If the seller cannot put people and products into various groups based on their willingness to pay, it is virtually impossible for them to price discriminate because without knowing what a customer likes and how much he is willing to pay for it, the producer would most likely lose money by trying to price discriminate by failing to maximize potential profit.

- Second, if a seller is to engage in price discrimination, the firm must make sure that there are barriers to arbitrage (resale of the good that is purchased) to a certain extent. This is important because the seller must ensure the group that buys the product at a discount cannot not resell the product to another potential customer at a lower price. A primary example of this is selling books. The only way a seller can price discriminate in a situation like this is only producing a hard cover copy at a higher price when it first comes out so the customers with a higher willingness to pay will buy it. It is almost virtually impossible to prevent arbitrage in this situation because once the person has read the book it is less valuable to them so they can resell it at a lower price. This is why it is hard for book sellers to price discriminate.

If these two requirements are fulfilled, then the seller can try to price discriminate based on one of three degrees.[1]

Looking at Price Discrimination for Network Goods

[edit | edit source]When looking at price discrimination as it pertains to information goods, it is important to note that most information goods have a high fixed cost, and comparatively low variable costs. This is attributed to the amount of time and money it costs upfront to create information goods. This applies to writing a book, coding software, or recording an album; nearly the entire cost of the product is incurred in the product's initial development. Reproduction cost is relatively low for information goods, and often insignificant.[2] An example of this is operating systems for computers. For example, the initial version of Windows cost Microsoft millions and millions of dollars to develop, but once it has been created, it can be reproduced for very little. Therefore companies face many decisions regarding how to price their product. This is often why companies employ different versions of price discrimination.[3]:

Examples:

- Bundling: Bundling refers to the practice of grouping products together to make the entire package more valuable than the individual products by themselves. An example of this is Microsoft Office. Upon purchase of Microsoft Office, an individual has bought a suite of 10 or so software products, even though most people value a few of the programs such as Word, PowerPoint, or Excel. (However, by bundling someone to purchase all 10 cheaper than the most desirable products individually, the consumer receives the products they want cheaper, while Microsoft is able to market their lesser-known products))), which have a better chance of being used than if they had to be bought individually.

International Price Discrimination

[edit | edit source]International Discrimination refers to price discrimination in which identical or nearly identical products are sold for differing prices, depending on where in the world they are sold. This is a tricky subject because factors such as foreign exchange rates—which fluctuate much more rapidly than price changes, must be taken into account. Another important thing to look at with international price discrimination are labor cost. This plays a big part in why identical products can be sold at different prices in different parts of the world.

Pharmaceuticals

[edit | edit source]International price discrimination is common in the pharmaceuticals market. This involves drug-makers charging more for drugs in wealthier countries than in poorer ones. This is observed in the United States, where drug prices are some of the highest in the world. For example, Europeans, on average, pay just 56% of what Americans do for prescription medications.[4] The varying levels of regulation and protection of intellectual property is seen as the reason for the U.S.’s high costs. This is also tricky in the U.S, because the country does not have as extensive health care plans compared to other parts of the world, particularly in developed nations. An example of this is the U.S compared to Canada. While it is true that prescriptive medicine is cheaper there than in the U.S, this is absorbed the taxes paid for by Canadians, which contributes to a lower average salaries when compared to those in the U.S.

Textbooks

[edit | edit source]Another market where this occurs is academic textbooks. Textbooks are much more expensive in the United States than they are overseas, even though they are usually the same books. If the books were printed in different countries, with differing production costs, than the difference in price could be because of this. However, most books, even international editions, are printed in the United States. This eliminates the conception that the cost of transportation may be a reason for higher costs of the books in the United States. If it’s assumed that distribution and marketing costs are similar in Europe and the United States, than price differences cannot be attributed to these costs. One explanation for the pricing differential is a difference in copyright protection laws. The United States is known for some of the strictest copyright laws in the world. This leads to lower amounts of competition from the illegal reproduction and copy of textbooks. In addition, textbooks are often a “required” part of college education in the United States, while in Europe and the U.K. textbooks are used more as study aids than mandatory readings.[5] Another important aspect for international textbook price discrimination is stopping arbitrage; otherwise, consumers could just buy the product where it is sold cheaper, and then resell them in places where they are more expensive.

In globalization this is used to penetrate all possible national markets by charging the maximum per quantity price that each market will bear. As described in regionalization, the price is discriminated varying by consumer, and the product is customized by the consumer group's particular needs, often contributing to social welfare. Unfortunately, while often this service can make certain goods, i.e. computers chips, more affordable in developing countries, it also can be used as an anti-competitive strategy, cutting existing competition, and creating a barrier to future entries. As a particularly complex issue, especially in the global market framework, cases must be reviewed individually by multiple nation’s regulatory agencies to determine any anti-trust violations. Price discrimination also can be essential to survival of the information goods market, due to the initial sunk costs involved in information good development. This is intuitively because these creation costs would not be recovered by marginal cost reproduction, since information goods are typically near free to reproduce.

As cited above pharmaceuticals are a prime example of localization within globalization. It takes decades to create, research, and realize a new synthesized drug, however once the formula is found it is usually as cheap to reproduce as it might be to manufacture tapes. In the global market for pharmaceuticals (firms* Band) has translated from winning doctors confidence in brand reputation, into a business game of strategy. Consisting of vertical/horizontal mergers, and embedment in insurance plans, which creates a monopoly-type control, in turn permitting price discriminating operations. However this profit realized by price discrimination is often needed to defeat loss of market share in wake of arbitration, and as mentioned above, often producing efficiency in fluctuating markets. For example common welfare is hurt by the rigidity of the price for HIV and AIDS drugs to third world countries in desperate need. A prime example of this is Africa, which faces the tragic loom of certain arbitration of these medicines to wealthier nation’s markets. In such cases limited quantity distribution to authorized groups, i.e. hospitals, priced at reduced rate, i.e. enactment of regional price discrimination, can ensure that the drugs are used appropriately, and not swept up by international arbitrage. (First draft will finish edit later today.)

Sources: To be cited -http://www.dfid.gov.uk/Documents/publications1/prd/diff-pcing-pharma.pdf -http://www.ftc.gov/reports/pharmaceutical/drugexsum.shtm -http://books.google.com/books?id=JgGyX4ocbjcC&pg=PA542&lpg=PA542&dq=Information+goods:+Pharmaceuticals&source=bl&ots=XObJIwCqmk&sig=J-PeE_xRm3X5ZC0jBp4rQhe_0cQ&hl=en&ei=3QfZTMnBGYSusAOv4eiNCA&sa=X&oi=book_result&ct=result&resnum=3&ved=0CCEQ6AEwAg#v=onepage&q&f=false

Penetration pricing

[edit | edit source]A marketing strategy used by companies to entice customers to buying the product or service is penetration pricing. By charging a lower price for a product, the company can achieve critical mass. Once the company achieves critical mass, after time passes and demand increases, the company then raises prices back up to the optimal level. Clara1 (discuss • contribs) When a company does this, their competitors may fail because they cannot keep producing at a loss. Similarly, a competing network may fail because it may lose enough members to fall below critical mass. On a positive note, the goal of penetration pricing is to build a successful product/network. Predatory pricing is another price lowering strategy. Penetration pricing and predatory pricing are alike in that both strategies involve lowering prices to increase demand; however, predatory pricing is used with an intent to drive a competitor out of business. A competing firm may fail when it is forced to lower prices below average costs for an extended period of time. As a result, the firm may see it less costly to shut down rather than keep operating at a loss. A competing business with network externalities will become less valuable to its members as more members switch to the cheaper network.

An example of predatory pricing is in the airline industry, American airlines in particular. American airlines main headquarters is in Dallas, Texas. American airlines has been charged with predatory pricing many times over the years because when a new airline enters the market, they simply charge below average costs until the new airline can not afford to stay in business any longer. A main reason why American airlines can do this is because they hold so much capital. Yet American airlines had to file for bankruptcy in 2011.

A main point of penetration pricing is for a company to attract buyers to use the product and hopefully market it, therefore it may increase demand for the product or service. For a company to successfully use penetration pricing strategy, they must make sure that the product or service is elastic enough such that consumers are attracted to buying it based on its lower price.

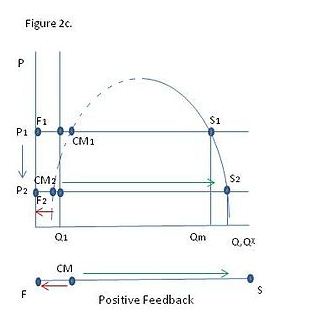

The model below shows how penetration pricing pushes the market and/or expectation toward success(point S). At P1 the expected size of the network does not exceed critical mass. Decreasing the price from P1 to P2 moves the critical mass point to the left. As a result, critical mass falls below the expected size of the network which is pushed toward point S by the positive feedback effect.

Penetration pricing also has its disadvantages. One disadvantage is that if you lower your price and your competitor matches your price, than the strategy might fail. Another disadvantage is that customers may perceive the lower price of your product to correlate to the quality of it. Therefore it could make your product as less valuable. Another disadvantage of penetration pricing is that the company attempting this strategy must have enough capital to stay in business until they can raise prices back up to the optimum level.

Penetration pricing is often used by companies that are trying to enter a new market, increase their sales, and gain a long term market share. These markets are usually highly competitive like electronics and gaming consoles. An example of this is when Sony posted a loss after the PlayStation 3 was released even though they sold thousands of PlayStations. Its low price was meant to draw people away from buying other gaming consoles. Sony was looking at long term revenues from when people started to buy games for the PlayStation 3 instead of other gaming consoles.

Discount stores also use penetration pricing in their marketing strategy. A great example of a discount store that does this is Wal-Mart. They offer new product at their stores at much lower prices compared to their competitors, hoping that once you are in the store to buy that one product, you will shop around and purchase more items. They are willing to lose money on some of the newer products so they can get customers in the door. Once they have the customers brand loyalty, they can start to gradually increase the price.

Pricing both sides of two-sided platform

[edit | edit source]A two sided platform can be seen where two users or groups interact with each other on a common platform. The best example would be video game console and games or game developers. In finding the price to set for each product for a two – sided platform depends on these factors:

- The price of elasticity’s of demand on each of the platforms. The side that is seem to be more valuable of the two platforms will pay more.

- The relative strength and characteristics of the indirect network can affect the two sides

- The amount of competition from other platforms and close substitutes of the product on both sides. These, also includes multi- homing and product differentiation.

This price structure is made to recover the start -up cost of one of the side or the other. Therefore you might see the amount someone pays for a product at a lower price to get more people to get in the platform and once they are in the platform the other product that works with that platform is set at a higher price to off- set the loss made from the first product.

References

[edit | edit source]- ↑ name=The Filter>AJE (2008). "Price Discrimination". The Filter.

{{cite journal}}: Text "urlhttp://thefilter.blogs.com/thefilter/2008/06/price-discrimin.html" ignored (help) - ↑ Varian, Hal (1995). "Price Information Goods".

{{cite journal}}: Cite journal requires|journal=(help); Text "urlhttp://people.ischool.berkeley.edu/~hal/Papers/price-info-goods.pdf" ignored (help) - ↑ Sundararajan, Arun (2003). "Pricing Information Goods".

{{cite journal}}: Cite journal requires|journal=(help); Text "urlhttp://oz.stern.nyu.edu/io/pricing.html" ignored (help) - ↑ Wood, Laura (2010). "2010 Chartbook of International Pharmaceutical Prices". Forbes.

{{cite journal}}: Text "urlhttp://www.forbes.com/feeds/businesswire/2010/09/13/businesswire145257697.html" ignored (help) - ↑ Clerides, Sofronis (2007). "Economic Letters: A textbook example of international price discrimination". Science Direct.

{{cite journal}}: Unknown parameter|urlhttp://www.sciencedirect.com/science?_ob=ignored (help)

[1].http://economics.fundamentalfinance.com/monopolies.php 2.http://digitaleconomist.org/pd_4010.html 3.http://economics.about.com/cs/microeconomics/a/monopoly.htm 4.http://www.corp.att.com/history/history3.html 5.http://ostpxweb.ost.dot.gov/aviation/domestic-competition/predpractices.pdf