Macroeconomics/Fiscal Policy

Fiscal Policy concerns the use of changes in the amount of government spending, G and taxation T to influence the national economy. This policy can affect both Aggregate Demand (AD) and Aggregate Supply (AS), though it is worth noting that the affect on AD is much more direct and immediate, whereas AS is affected through indirect means over a greater period of time. It is also just about impossible to isolate the two effects - any change in fiscal policy will ultimately affect both AD and AS.

Aggregate Demand

[edit | edit source]As we already know, AD = C + I + G + (X - M) where 'G' stands for government spending. Taxation is accounted for in the affect it has on the other components of aggregate demand (for example, consumption will fall if more is spent in paying taxes!).

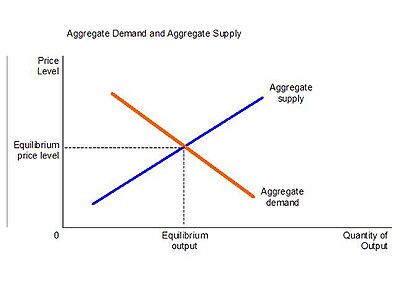

Increases in government spending will increase aggregate demand, which will have affects on the economy overall. It leads to an increase in output and average prices, other things being equal. However, the degree to which output/prices rise depends on the elasticity of AS. This can be easily shown on an AD-AS diagram:

If Aggregate Supply is elastic, a large increase in output may result with little risk of inflationary pressures. However, if AS is inelastic increased government spending may not be the best way of boosting the economy, as it is at risk of 'overheating' - that is, at risk of causing inflation rather than growth in output.

Similarly,,, a fall in government spending will 'cool' the economy, and cause a contraction in AD: diagram>

Aggregate Supply

[edit | edit source]Specific changes in fiscal policy can be used to affect aggregate supply:

Capital Spending

[edit | edit source]Government spending on infrastructure, such as new transport networks, increases the potential output of an economy. Also, lower corporation taxes mean that businesses can invest greater sums at the same time, contributing both to AD and AS.

Capital spending could also include investment in 'human capital', such as retraining, higher education and vocational training as ways to increase the supply of labour, reduce unemployment and provide a more productive workforce. Human capital is becoming ever more important as many developed countries now aim for a knowledge-based economy, in which labour is more productive.

Workforce Incentives

[edit | edit source]Changes in the benefits system, such as a reduction in income tax, could create greater incentive for individuals to return to work. This increases labour supply, and hence overall supply as labour is a factor of production. It could be argued that welfare and benefit reform is more important ie. fewer benefits for the unemployed to incentivise them to work.

R&D and Innovation

[edit | edit source]Increased G could encourage developments in technology, which also increase the potential output of an economy, though without an accompyaning increase in demand, this will only increase 'slack' in the economy, reducing inflationary pressure, rather than an actual increase in total output.

These AS effects are dependent upon carefully targetted government spending, and it is important to note that government spending alone will not necessarily affect AS.

Fiscal Policy Terms

[edit | edit source]- Expansionary Fiscal Policy = G > T. That means that government spending is greater than the rate of taxation, so it is a boost to the economy. The disadvantage to this is that a budget deficit will ultimately build up

- Contractionary Fiscal Policy = G < T. This has a contractionary, deflationary effect on the economy, but it will improve the government finances over time